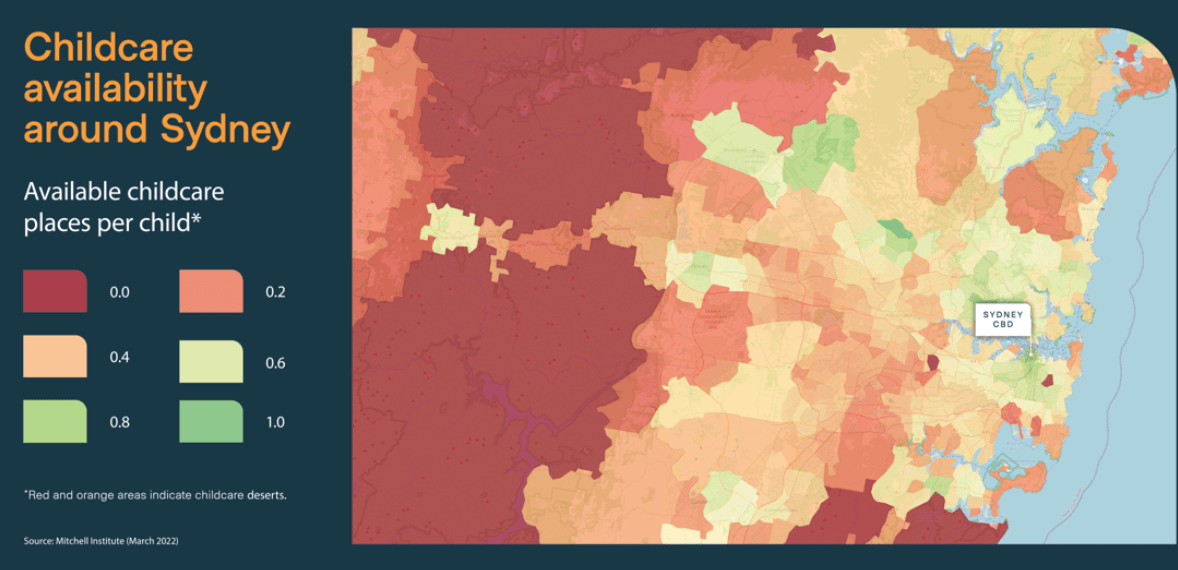

With Victoria University’s Mitchell Institute warning that 28.8% of the population in Australia’s major cities live in ‘childcare deserts’, the demand for new childcare centres continues apace.

The Mitchell Institute’s research, published in March 2022, found the median for major cities was only 0.42 childcare places per child. Not surprisingly, the numbers are even starker in regional Australia.

As Burgess Rawson Head of Agency Adam Thomas says: “With the current childcare boom [Burgess Rawson has overseen the sale of 90 centres since January 2021] there are suburbs where supply is meeting, or even exceeding, demand, but these are still very much in the minority.

“There are huge opportunities in childcare and the Mitchell Institute has produced online maps showing where these ‘childcare deserts’ are.’

As the 2022 Federal Election campaign has shown, there is bipartisan support for significant subsidies so that parents can afford to send their kids to centre-based day care services. “Nowadays it’s simply a contest of who can promise more,’ says Adam.

“The political argument has been well and truly won that the more difficulty parents have in accessing childcare, the more likely it is that they won’t work while their children are young.

“Governments of both persuasions know the value of work for both mental wellbeing and for the greater good of the economy, while kids benefit from greater interactions with their peers.’

It is a far cry from the dark days of 2008 when ABC Learning’s empire of 1136 Australian childcare centres collapsed under a mountain of debt.

“All too often history repeats itself,’ says Adam, “but ABC Learning’s collapse caused such shockwaves that Government and industry both sat up, took note, and swore this would never happen again.

“The extraordinary financial assistance that the Federal Government handed out to the childcare sector, over and above JobKeeper, showed that there is no appetite for a repeat of ABC Learning’s demise.’

Australia’s largest ASX-listed operator G8 Education also provided some key learnings to the industry with its four-year experiment building ‘supersized’ childcare centres now officially over, according to Adam.

As G8’s Gary Carroll said, several of the 13 new centres that had to be written down in value last year were large ones of more than 180 places. “In terms of size, we’ve learnt through the experience that larger isn’t better,’ said the well-respected CEO. “A sweet spot for us is probably about 80 to 100 licensed places.’

As for Adam, he is looking forward to continuing his association with the childcare industry. “I’ve been selling Queensland childcare centres from Melbourne, so I will find it just as easy to sell Victorian centres from Brisbane,’ he says.

“The one thing we know about the childcare industry is that it is growing even faster than my Frequent Flyer points.

“Burgess Rawson oversees the sales of more childcare centres than all our competitors put together. It’s a great position to be in, and one that we have no intention of relinquishing.

“To be the dominant player in an industry that is strong, protected, essential and constantly growing is a perfect trajectory for us and our clients.’