How has the Election outcome affected commercial property investment?

The major difference during the 2022 Federal Election campaign to previous elections is the policies have not created uncertainty around property taxes and investment, and or the first time ever the commercial market continued undeterred.

Labor avoided reforms to capital gains and negative gearing after their proposed policies in 2019 resulted in their defeat, and winning Teal Candidates Zoe Daniel and Monique Ryan have specifically stated they do not support changes to negative gearing, franking credits and trust taxes.

As a result, the new Labor government is unlikely to have a major bearing on market conditions, and even rising inflation and interest rates so far have had little impact on buyer demand and prices.

Labor Policies have focused on the popular residential market and the “Help to Buy’ scheme is extremely limited – 10,000 assistance packages against 100,000 first home buyers.

Their bold Housing Australia Future Fund for 30,000 social housing properties will drive the construction industry and provide much needed help.

Key market factors and what they mean for investors.

Breaking down the property investment journey, there are key ways investors pay tax: Stamp Duty, Rates, Land Tax, Capital Gains and GST. Only the last two are Federal taxes, and Labor steered well clear of any policy change during the election campaign.

Stamp duty initiatives and savings offered by some states has encouraged cross-border and regional transactions.

Geographically diverse portfolios can act to reduce multiple holding land tax penalties, or to make the most of stamp duty concessions.

This has created investor markets for industry, often prioritised over location – for example an investor will look at the purchasing of a drive thru fast-food operator regardless of location, and compare properties like for like.

In evaluating a potential purchase opportunity, investor calculations now include buying costs, such as stamp duty and non-recoverable costs such as land tax.

State governments are addicted to the flow of property taxes. In Victoria alone, property taxes represent 14% of total revenues. There is no reason for State governments to discourage investment or to drive commercial real estate prices down.

Will surging inflation and rising interest rates curb commercial property demand in 2022?

With strong price growth and increased interest particularly in the industrial and retail property segments achieved over the past two years, the biggest challenges facing investors now are inflation and anticipated interest rates rises.

Australia’s CPI rose by 5.1% in the 12 months to the March 2022 quarter, the biggest annual change since the introduction of GST in 2001, and the RBA increased the cash rate from a historic low of 0.1 per cent to 0.35 percent, the first of several expected interest rate rises to bring inflation under control.

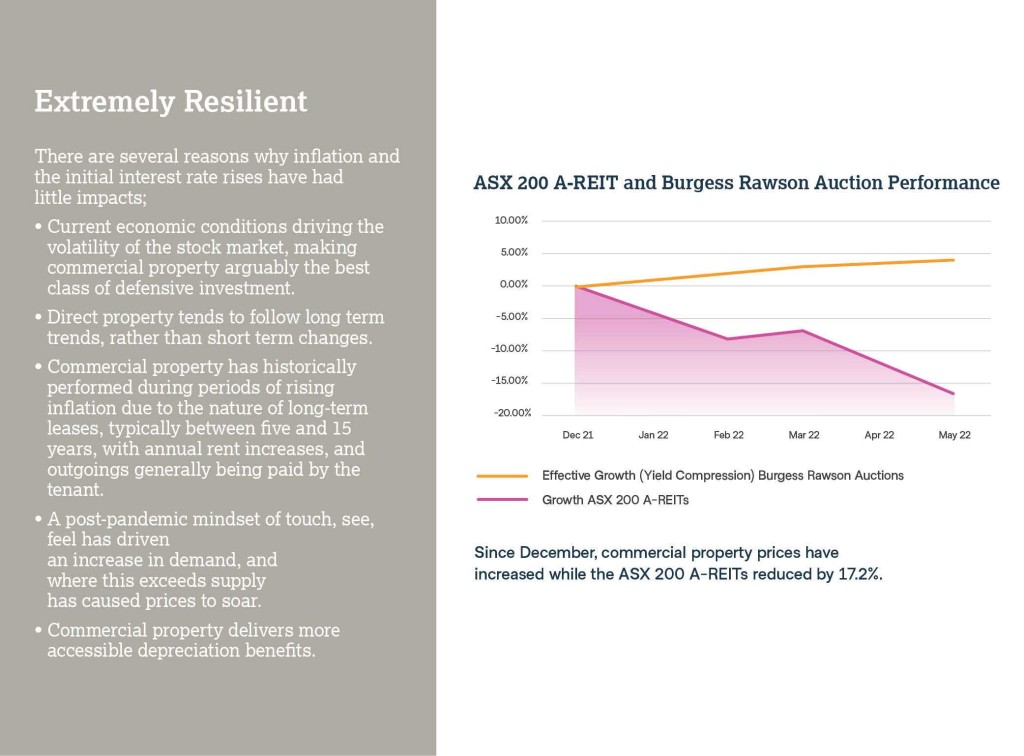

Comparing our March and May Portfolio Auction results showed that commercial property investors were undeterred and yields continue to tighten. In March we sold $185 million worth of property on a blended yield of 5.02% and in May – after the RBA moved on interest rates – we achieved $130 million in sales at a blended yield of 5.00%.

Furthermore, the Weighted Average Lease Expiry (WALE) for our May Portfolio Auction was 8.7 years, which highlights the stability offered by commercial property. Given the significant economic changes that have occurred since the Covid pandemic began, and an outlook of continued inflation and interest rates

rise, such certainty is welcomed and embraced by investors.

While some economists expect the Reserve Bank to increase the cash rate to 1.5% by year end and 2% by the middle of next year, this is not expected to have a significant impact on the demand for commercial property as certainty and behaviours shift post the pandemic.

“Yields at Burgess Rawson Portfolio Auctions compressed by 22 basis points between the December and the May Auctions despite the cost of money increasing 100 basis points over the same period.’

What we do know is that premium property continues to demand premium pricing, as investors seeking quality are willing to pay, and generally do so with a long-term view.

Supply constraints on key infill in metro locations will help maintain land values and property pricing. So, despite the big shift, commercial property outlook is strong and we welcome the new Government.