Fast Food Investments – The Ultimate Winning Strategy

06/05/2024

In a culinary setting as diverse and dynamic as Australia’s, the rise of the fast food industry is nothing short of a phenomenon.

Fast food revenue soared to a staggering $23.2 billion in 2023, highlighting the sector’s substantial economic impact, despite restrictive inflation conditions in recent times.

With established giants like McDonald’s, Hungry Jack’s, Subway and KFC, alongside rising contenders like Guzman y Gomez and El Jannah, fast food chains have firmly entrenched themselves in the hearts and wallets of Australians, cementing their status as key players in the fast food landscape.

The fast food industry is in a perpetual state of evolution, with customer preferences and industry standards shifting more rapidly than ever before.

Brands are being pushed to diversify and adapt as new players are entering the fray, bringing with them fresh concepts that challenge the status quo.

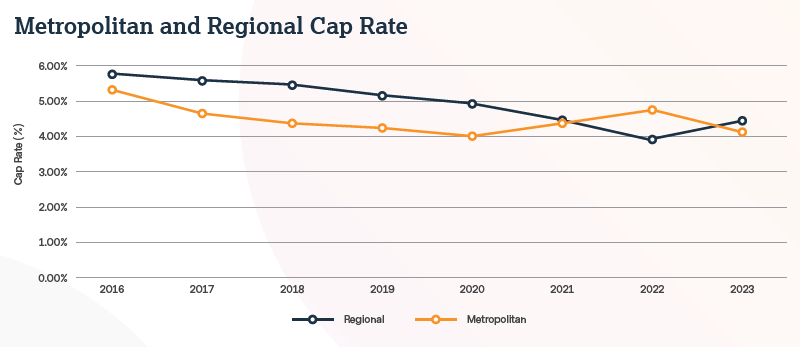

In the face of evolving market dynamics and consumer needs, operators like KFC have demonstrated remarkable adaptability. They’ve responded to the challenges of higher land costs and the scarcity of space by introducing drive-thru-only stores that forgo the traditional dine-in area.

By strategically downsizing where necessary, primarily in metro locations, they’ve reduced their space requirement to just 1,000 sqm — half of what was typically needed before – allowing them to maintain a competitive edge and presence in highdemand locations where land is at a premium, without sacrificing service speed or quality.

Australia’s love affair with fast food is undeniable, and this trend has contributed to the incredible property market fundamentals within the sector.

And it’s more than just convenience and affordability fuelling our unabated affection for fast food, although those are undoubtedly significant factors. For consumers, the delivery of satisfying meals at lightning speed caters to our increasingly fast-paced lifestyles.

Recent consumer surveys substantiate this demand, with over 55% of Australians consuming fast food at least once a week, and services like Uber Eats enhancing accessibility and further ingraining fast food into our daily routines.

As consumer demand for fast food continues to escalate and outlets expand, investing in fast food has emerged as a winning strategy for those seeking stable returns in a rapidly evolving and expanding market.

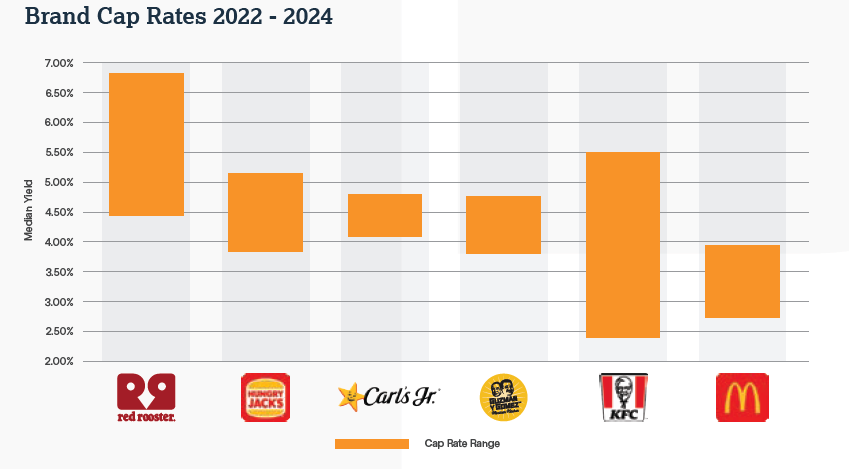

Burgess Rawson’s forthcoming Fast Food Industry Insights report finds that demand to buy these assets continues to surpass supply resulting in record low yields being achieved.

As a prime illustration, our recent transaction of McDonald’s in Cardiff NSW boasted an exceptional yield of just 3.25%.

The resilience of the sector and ongoing consumer commitment amidst economic fluctuations cannot be overstated. Fast food has proven itself as the benchmark of stability and growth, attracting eager interest from investors.

This enduring strength is also reflected in the impressive financial performances of some of the industry’s leading players. With a strategic blend of long-term vision and adaptive strategies, these brands are not just surviving but thriving, demonstrating the kind of robust growth that solidifies their place at the top of the food industry’s hierarchy.

In 2023, privately-owned Hungry Jack’s saw a remarkable $2 billion in sales, marking a 12.6% increase. Similarly, Collins Foods, the largest operator of KFC franchises in Australia, reported a robust 14.2% revenue increase to $1.349 billion, with growth across all business units.

McDonald’s reported that one in four coffees sold in Australia is from its outlets, contributing significantly to its $2 billion in sales for 2022-23.

“Fast food assets continue to demonstrate their recession-proof nature, as convenience remains a key fundamental driving investor demand.’ – Yosh Mendis, Burgess Rawson Partner

Looking ahead, the future of the fast food industry in Australia appears brighter than ever. Major investments from mega brands, coupled with ongoing evolution within the sector, promise continued growth and innovation.

In fact, in 2023, McDonald’s announced it is rolling out 100 new stores across Australia over the next three years in its biggest expansion plan in decades. The cost of the expansion is around $600m and McDonald’s also plans to upgrade over half its current store network that will cost another $450m.

Furthermore, American burger chain Wendy’s has announced ambitious plans to establish 200 stores in Australia by 2034, exemplifying the sector’s potential for expansion.

The fast food phenomenon in Australia serves as a testament to the evolution of our tastes and preferences, and shows no signs of slowing as we continue to enjoy more choice and an ever-improving experience from the brands we know and love.

Outselling our closest competitor 5 to 1, our leadership is undisputed, our track record speaks volumes, and our industry data is unmatched.

Our latest portfolio, meticulously curated, offers an exclusive array of unrivalled opportunities boasting premium locations and tenancies, promising stable returns for generations to come.