Burgess Rawson Partner and Head of Asian Investment Services, Zomart He said pubs and liquor assets have consistently delivered strong profits, and their evolving roles are further solidifying their attractiveness as investments.

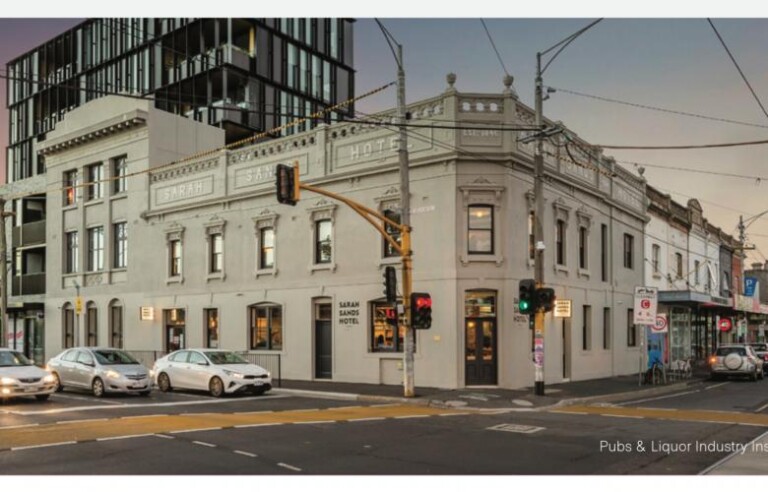

Investor interest is pouring into Australia’s pubs and liquor sector, with these long-standing cultural icons now driving significant shifts in the commercial property market.

According to the latest Burgess Rawson Pubs & Liquor Industry Insights report, pubs and liquor assets have consistently generated high returns, with metro Victoria pubs alone recording $166 million in sales since 2022. The resilience and adaptability of these venues are further solidifying their appeal as lucrative investment opportunities.

Burgess Rawson Partner and Head of Asian Investment Services, Zomart He said these assets have consistently delivered strong profits, and their evolving roles are further solidifying their attractiveness as investment opportunities.

The Burgess Rawson report shows that demand to buy leased hotel and liquor assets is increasing with cap rates now sub 5.0 per cent.

Since 2022, leased pubs and liquor investments in metro Victoria have recorded the highest value in sales at $166 million with a median cap rate of 4.36 per cent.

New South Wales metro pubs offered the sharpest cap rate of 3.59 per cent, however sales volume was lower at $32.445 million.

According to the report, post-pandemic, there was a noticeable resurgence in pub attendance, and by the end of 2021, with around 70% of Australians reported visiting a pub at least once a month.

“Since 2021, patrons are now spending approximately 15% more on liquor than they did pre pandemic.’

Mr He said hotels, pubs, and liquor assets have become more than just local fixtures; they are now transforming into multifaceted venues. Hotels offer a blend of luxury and practicality, enhancing guest experiences with modern amenities and technology.

Burgess Rawson Partner, Darren Beehag said pubs are evolving into vibrant hubs that integrate dining, entertainment, and retail elements, while liquor outlets are expanding their roles to include sophisticated beverage offerings and diverse retail experiences.

“This shift towards premiumisation reflects a growing consumer preference for high-quality experiences, making these investments increasingly lucrative.’

Key players like Endeavour Group and Dan Murphy’s have become solid and trusted tenants in this asset class, further adding to its appeal. Their long-standing presence and commitment to quality and innovation contribute to the stability of these investments, reinforcing their value as prime commercial assets.

Burgess Rawson’s report illustrates how the sector has demonstrated robust performance in recent years, bolstered by quick adaptation to online sales and delivery during the pandemic.

Mr He said the industry’s ability to pivot seamlessly to digital and other unique platforms while maintaining the allure of traditional experiences has strengthened its market position.

“The future of pubs and liquor assets looks bright, underpinned by solid market fundamentals and a strong consumer base. We envision an era of growth driven by innovation, strategic investments, and a continued focus on customer experience.

“The impact of this shift is evident in the ongoing refurbishments and upgrades across the sector. This industry is not just evolving; it is thriving by embracing technological advancements to enhance customer experiences and operational efficiency. From sophisticated digital ordering systems to state of-the-art entertainment facilities, the modern pub is a hub of innovation and engagement,’ he said.

The Hotel Conversation