Burgess Rawson has sold a 55,000sqm Large Format Retail (LFR) centre, anchored by one of Australia’s largest Bunnings Warehouse stores, for $99.6 million.

The Hoppers Crossing centre in Melbourne’s western growth corridor exchanged unconditionally on a blended initial yield of 4.25%, just six days after the close of an Expressions of Interest campaign.

Bunnings Warehouse generates 73.8% of the net income and is complemented on the site by Amart Furniture.

The property attracted 167 enquiries and competitive bidding from a wide range of private, institutional, domestic and international investors before selling to a private Asian investor who recently immigrated to Sydney from Hong Kong.

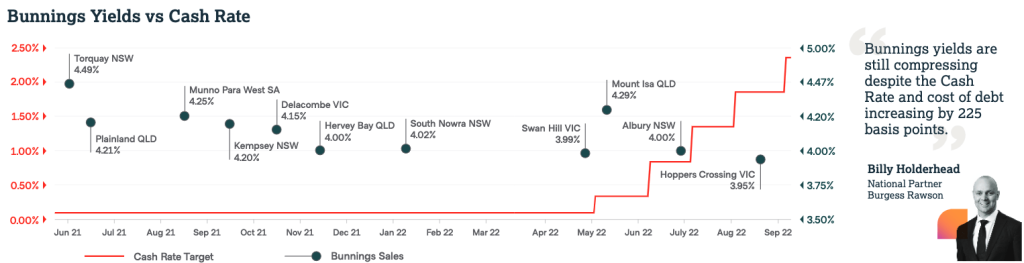

The successful purchaser apportioned $79.2 million of the total price towards the income from Bunnings which, in isolation, reflects a record 3.95% net yield in the Bunnings freehold investment market.

The new benchmark surpasses the 3.99% yield for Bunnings Swan Hill sold in April, despite the Cash Rate and cost of debt increasing by 125 basis points in the months since that sale.“The resilience of blue-chip retail property in the face of fast-rising interest rates is extraordinary, particularly for Bunnings, Coles and Woolworths-leased investments,’ said Burgess Rawson National Partner, Billy Holderhead, who led the sale campaign.

Private Investors Are Now Driving the Market

“Private investors are back in the driver’s seat in terms of competition for these high-profile properties,’ said Mr Holderhead.“The relative cost of debt, gearing pressures and corporate governance have very quickly put institutional investors at a disadvantage, in comparison to the private market.“After a long period of market dominance by the REITs for properties such as this, the pendulum has now swung back in favour of the private market.

“Private investors don’t answer to a Board or investment committee, they make much faster decisions and are typically sitting on a lot of cash or have very low LVRs across their portfolios – or a combination of both.’

Boring is Best

Beau Coulter, Partner at Burgess Rawson in Melbourne, said investors were shrugging off higher interest rates because of the stability offered by commercial property compared to other investment alternatives.

“Compared to the share market, for example, commercial property offers a much more stable investment journey underpinned by long term leases to top tier tenants,’ said Mr Coulter. “Instead of investing in Wesfarmers, Woolworths or Coles shares and sweating on the daily market fluctuations, property investors are parking money in bricks and mortar with secure, long-term leases to these same groups.“Relatively speaking, it’s boring, but that’s the appeal.

“Private investors have other things going on in their lives, be it with their businesses or their families; so, the less they need to think about their investment properties, the more valuable they tend to be.’

Buyer Preference

The Hoppers Crossing property was offered with a clean Plan of Subdivision which was ready for lodgement and would have reduced non-recoverable outgoings in the immediate and long-term, however the successful buyer preferred physical simplicity over management simplicity.

“Despite reducing his net return, the buyer opted out of the Plan of Subdivision because he wanted a single, 55,000sqm title,’ said Burgess Rawson’s Head of Asian Investment Services, Zomart He.

“The Land Tax advantages attached to the proposed Subdivision weren’t enough for him compared to the long term future value of such a landmark site on Old Geelong Road.’