Removal of stamp duty encourages monumental growth

In recent times, the conversation surrounding the abolition of stamp duty has gained momentum, heralding a potential transformation in the landscape of property transactions, particularly in the commercial sector.

The abolition of stamp duty has already demonstrated it stimulates broader economic activity. Increased commercial property transactions generate employment opportunities, boost construction and development, and contribute to the overall economic vitality of the region.

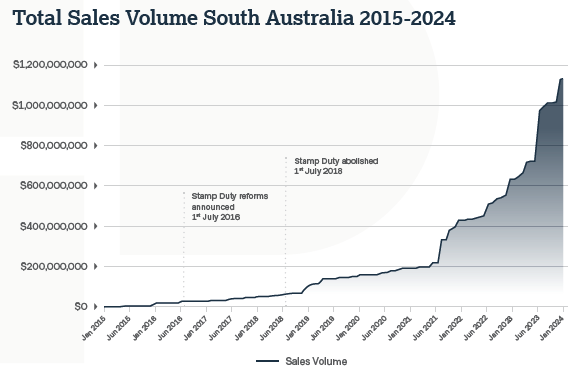

South Australia was the first to take the bold step of completely removing stamp duty from 1st July 2018, with the government recognising its role as a barrier to the fluidity of commercial property transactions. The move paid off by significantly boosting economic growth for the state and the commercial sector whilst attracting investment both locally, and globally.

The savings provided to commercial investors was also immense. As an example, the stamp duty saving on a $1 million commercial property purchase equates to $48,830, while on a $5 million investment it presents a $268,830 saving. A $10 million transaction sees a whopping saving of $543,830.

The removal of the tax sparked significant interest in commercial assets within the state. This trend hasn’t slowed, as evidenced by an uptick in Burgess Rawson transactions in the wine state. At our recent portfolio auction, all South Australian assets offered were sold, resulting in a 100% success rate.

Notable transactions from the event included the sale of PFD Foods in Whyalla for $1.16 million and an entry-level investment in Port Augusta leased to the Aboriginal Drug and Alcohol Council Services.

There’s no doubt the removal of stamp duty on commercial property transactions in South Australia has yielded significant benefits for the state’s economy and to investors. Notably, it has substantially fostered a more competitive business environment.

Construction activity and a strong job market have propelled South Australia to the top of the economic performance leaderboard, according to CommSec’s quarterly State of the States report. This is the first time South Australia led the pack in the survey’s 14-year history of quarterly reports.

Following South Australia’s lead, the Victorian Government has also recognised the impact of stamp duty on economic mobility and property market dynamics.

In a move expected to benefit the Victorian economy by up to $50 billion, stamp duty on commercial and industrial property will be abolished and replaced with a commercial and industrial property tax.

The evidence shows the abolition of stamp duty on commercial property transactions has the potential to unlock a new era of dynamism in the market.

By removing the financial barrier associated with stamp duty, businesses can allocate capital more efficiently, driving economic growth and fostering a more agile commercial property sector.

As South Australia leads the way in abolishing stamp duty on commercial property transactions, and Victoria adopts similar reforms, the Australian property landscape stands at a pivotal juncture. The potential benefits for businesses, investors, and the broader economy signal a paradigm shift in how Australia approaches taxation in the realm of commercial property.

The winds of change are blowing, and the impact of these decisions will be closely watched as other states may consider following suit in the quest for a more efficient and dynamic property market.

Amidst these industry shifts, Burgess Rawson remains at the forefront of navigating and adapting to the changing landscape on behalf of our clients. With a deep understanding of market dynamics and a commitment to staying ahead of industry trends, we continue to provide invaluable expertise and guidance to clients seeking to steer these changes effectively.

Stamp duty at a glance

Victoria – 1.40% – 6.40%

Commercial property buyers typically pay stamp duty ranging from around 1.40% to 6.4% of the purchase price, with variations based on the property’s value and other factors. Starting July 1, 2024, commercial and industrial properties sold will transition to a new system, with an annual property tax due ten years after the transaction. This tax will amount to 1.00% of the property’s unimproved land value.

New South Wales – 1.25% – 6.75%

Stamp duty rates for commercial property transactions range from approximately 1.25% to 6.75% of the purchase price, with higher rates applicable to more expensive properties.

Western Australia – 1.90% – 5.15%

Stamp duty rates on commercial property transactions in Western Australia vary from approximately 1.90% to 5.15% of the purchase price, with rates based on the property’s value and other factors.

Northern Territory – 2.00% – 5.75%

Stamp duty rates on commercial property transactions in the Northern Territory range from approximately 2.00% to 5.75% of the purchase price, depending on factors such as property value and intended use.

Australian Capital Territory 4.00% – 6.25%

Commercial property buyers in the Australian Capital Territory may pay stamp duty ranging from approximately 4.00% to 6.25% of the purchase price, with rates based on property value and other factors.

Queensland – 1.50% – 5.75%

Stamp duty rates for commercial property transactions in Queensland range from approximately 1.50% to 5.75% of the purchase price, depending on various factors including property value and intended use.

South Australia – 0%

South Australia has abolished stamp duty on commercial property transactions.

Tasmania – 2.00% – 4.50%

Stamp duty rates for commercial property transactions in Tasmania typically range from around 2.00% to 4.50% of the purchase price, with variations based on property value and other factors.