Large Format Retail

Large Format Retail Property for Sale

The large format retail sector has seen significant growth in recent years, not just weathering economic downturns but reaching new sales highs. Location, accessibility and big retail brand presence has always been the big drawcards to retail hubs where consumers are encouraged to touch, feel and compare products.

But even as we see an increase in Australians’ online shopping habits, data shows that footfall within stores has not suffered as a result. In fact, consumers are still descending upon the likes of The Good Guys, Officeworks, Kmart and Bunnings in their masses, and having already conducted their research online, they in fact arrive in store already committed to their purchase.

Key operators are reporting phenomenal growth as this asset class matures; JB Hi Fi, Wesfarmers, BCF and Bapcor Retail have all achieved strong sales growth in the last 12 months as consumers continue to enjoy non-discretionary spending, even in the face of continued interest rate rises.

There are many reasons to consider adding large format retail assets to your portfolio.

The vacancy rate for large format retail assets in Australia decreased from 5.2% in 2021/22 to a record low of 3.5% in 2022/23. This tightening reflects a growing demand for these assets, particularly given the limited new floorspace being added to the market. As a result, rental rates for LFR assets are expected to continue to ride, along with their asset values. This trend indicates strong market conditions to come for large format retail in Australia.

Sold Large Format Retail Properties

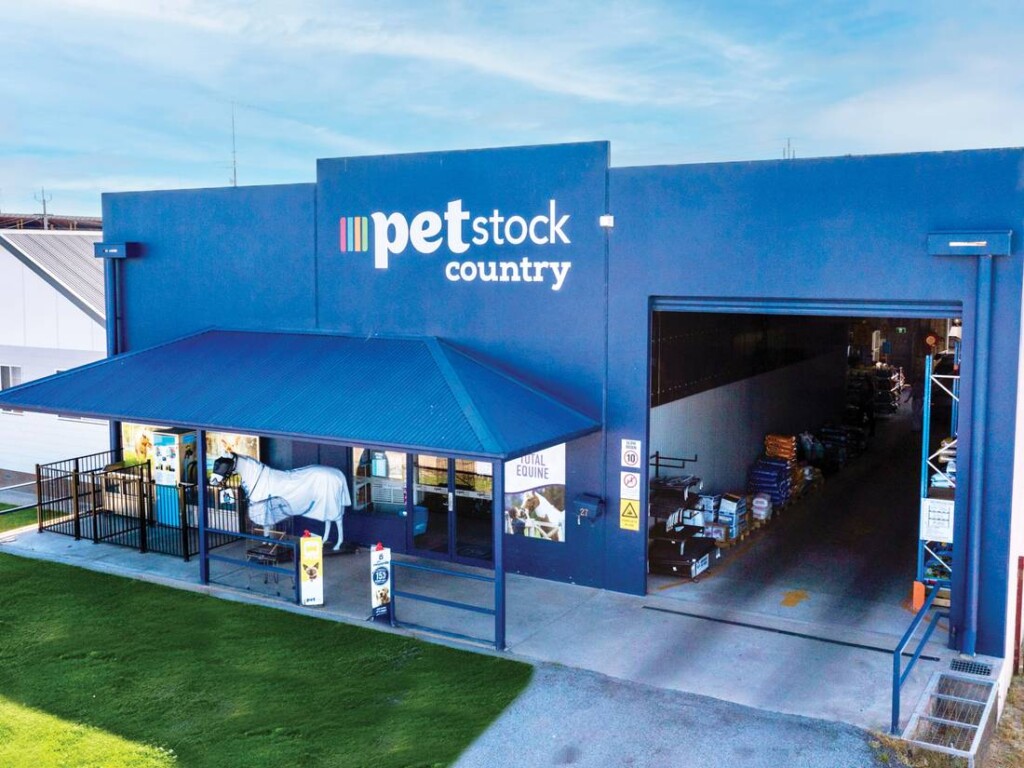

Affordable Petstock Investment | 15 Year Net Lease to 2037

Leeton NSW

27-29 Acacia Avenue- Contact Agent

West Gosford NSW

9 Marstan CloseCoffs Harbour NSW

27-29 Walter Morris Close- Contact Agent

Australind WA

15 Antlia Way- Contact Agent

Midland WA

163-169 Great Eastern Highway- Contact Agent

Frankston VIC

64 Dandenong Road West- Contact Agent

Mornington QLD

23 East Street- Contact Agent

Australind WA

19 Antlia Way- Contact Agent